And as U.S. Growth Estimates Are Slashed - The Fed's Done Tightening

Next week – on February 28 - the fourth quarter 2018 Gross Domestic Product (aka GDP) is set to release.

And after such an optimistic view by the market all last year – expectations are crumbling now. In a big way.

For starters – my anemic growth views haven’t changed.

And just in case you missed it - back in early December 2018 - I tweeted that I expected U.S. Q4/2018 GDP to come in way below market expectations. Somewhere in the mid-1% range (which was roughly 50% below then current estimates).

At the time, the U.S. yield curve was flat and heading towards inversion – a great historical indicator of an upcoming economic recession.

But since then, more than 40% of the yield curve's inverted (I wrote about this more last week – check it out if you haven’t).

This yield inversion is a telling sign. We see that long-term bond investors don’t believe the Federal Reserve's ‘growth’ story. If they did, they wouldn’t be buying longer term bonds that yield less than short-term bonds. (They’re doing this because if they expect the Fed to soon cut rates, they then want to lock in the yield from these relatively higher yielding long-term bonds today).

Putting it simply - they don’t believe growth or inflation are around the corner, but instead, rather a recession and deflation

I wrote about this a while back – how bond investors were beginning to call the Fed’s bluff. And that the U.S. was heading towards a cyclical downturn ever since the Fed raised ‘real’ rates higher (real rates = nominal interest minus inflation).

So if inflation is 2% and the Fed set nominal rate's at 2.5% - there’s a real interest rate of .50%. And that’s actual tightening.

At first - the mainstream financial media and Fed bankers shrugged off anyone doubting higher U.S. growth. They kept saying how strong the economy was. And that the Fed should actually hike and unwind their balance sheet (via Quantitative Tightening) even faster since things were going so well.

Thankfully anyone that remained skeptical of these words and positioned their portfolios instead for a weaker economy did well. Because these pundits and bankers were dead wrong.

For instance. . .

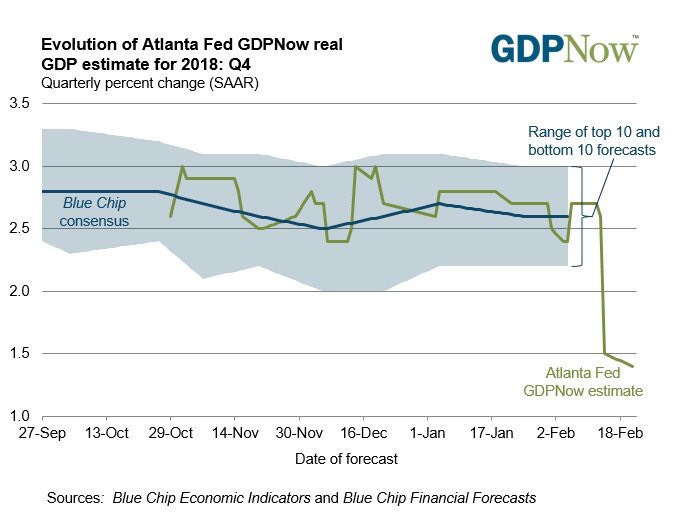

Yesterday the Atlanta Fed reduced their GDP estimates greatly - all the way from roughly 2.75% down to an anemic 1.4%. . .

Take a look at that sharp drop.

That’s a large re-pricing for the market on growth expectations.

Adding salt to the wound – the St. Louis Fed President James Bullard did a sharp reversal and told CNBC that he believes rate hikes and the QT bond selling program are “near an end”.

Further he claimed that interest rates are now “a little too high” (seriously?).

"I thought at the December meeting, myself I thought it was a step too far. I argued against that move," Bullard said. "We did get a bad reaction in financial markets. I think the market started to think we were too hawkish, might cause a recession." – said Bullard via CNBC

Said otherwise – the U.S. economy won’t be able to sustain itself with such higher short-term rates and lack of liquidity. And the market’s catching on.

Next is the just released Philadelphia Fed’s ‘Philly Fed Index’ data that came in at its lowest monthly decline since 2011. And first negative reading since May 2016 (anything below zero indicates worsening conditions).

Even J.P Morgan cut their Q1/2019 GDP estimates to just 1.5%. . .

I still maintain that Q4 GDP will come in the mid-1% range and that U.S. and global growth is in a cyclical slowdown.

The stronger U.S. dollar and higher ‘real’ rates are causing pain for Emerging Markets that have a wall of debt needing dollar refinancing. Especially China with their wave of soaring defaults (I touched on this yesterday if you missed it).

I wrote in November that U.S. Q3 GDP was artificially boosted because of the Trump Tax Cuts, heavy government spending, and one-off events like huge soybean exports.

But all these things – especially the Trump Tax Cuts – are wearing off. And with the Fed's over-tightening, there’s a lot working against domestic and worldwide growth.

Because of this - I expect the Fed is done tightening for good. And rather they'll actually begin cutting rates sometime late 2019. But that poses a problem for them as they won’t have much room to cut.

Remember: historically an economy needs 3% or more in cuts to get any kind of stimulus (benefit). But the Fed rate's only at 2.5% as of now. This means they’ll most likely go below zero and into negative territory in the next recession.

But I’ll touch more on this in another article. . .

Unless anything significant happens otherwise – expect global growth and incoming data to continue under-performing and sliding downwards.